In the current competitive climate of the private capital markets, it’s easy to understand how and why an investment banker could be complacent: the universe of buyers is so large, and so diverse. Even small add-on deals are getting attention from sophisticated buyers with long-term roll-up plans. While the “if you build it, they will come” strategy works for many, it’s far from a best-in-class practice.

Sponsor relationships require attention and care – especially those with the buying power that sellers expect to receive in exchange for the banker’s fee or retainer. Neglecting those relationships in a “seller’s market” is not only foolish, but costly.

In this article, we review four ways for investment bankers to perform a “deal sponsor relationship health” self-assessment of sorts that is sure to kick-start business development efforts as we head into the busy season.

Who do we really care about?

It’s critical that you and your team have opinions about which sponsors you want to cover and how often. While having a broad base of sponsors to choose from is valuable, it’s also important to assess which of the high-powered buyers you’ve reached out to in the past two years (and will expect more deals from you), and who else besides the usual characters could become valuable contacts in the years to come.

For example, if your firm is pursuing a industry-based business development strategy for finding sellers to represent, and as such is attending many industry-specific conferences, a best practice would be to target those sponsors who will also be in attendance.

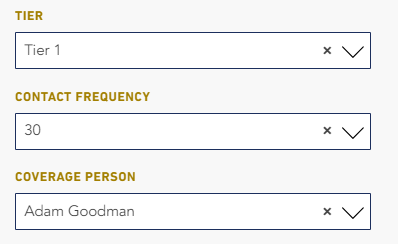

Having categorization systems for these high-powered sponsors is an easy, effective way to streamline your teams relationship-building efforts. This categorization/tiering system will help dictate how often sponsors should receive general communications from the firm, and which deals they should receive.

How long has it been?

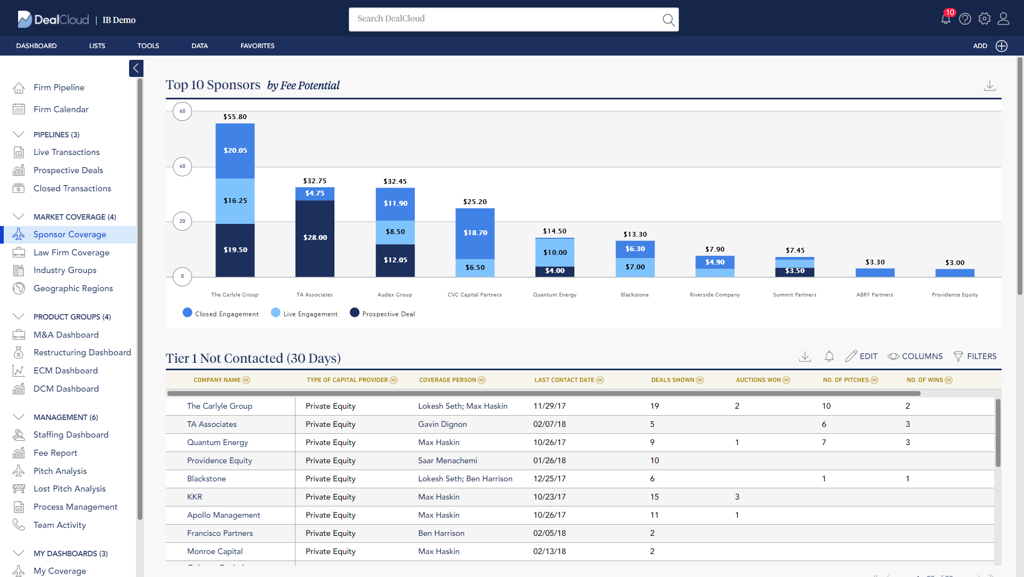

One such tool that investment banks love to leverage for relationship-building is the “Days Since Last Activity” filter. This function, found conveniently within a CRM platform, makes it easy to look up how long it’s been since you, or someone on your team, has spoken with certain key contacts or organizations.

When leveraging this tool, we always suggest doing your “future self” favors: if there’s a relationship that needs development, set triggers within your CRM system to remind you to reach back out. For investment bankers, we suggest tailoring the cadence of outreach based on buyer type. For example, large and hungry private equity firms likely don’t mind getting “check-in” calls from bankers once a month. Corporate development professionals, however, may be more receptive to a well-timed, curated email.

No matter how long it has been since your last conversation, make sure to log and look up notes about what was discussed, so it can be referenced during the next meeting. This will help your team pick up the relationship right where it left off.

Do we know their buying power?

Another way to identify and strengthen relationships with high-value groups is to track their buying power explicitly within your CRM. We’ve seen many investment banking firms diligently track data like fundraising activity, volume of closed transactions and bids in order to assign a “buying power” score for the sponsors that they cover.

Having a sense for buying power makes for endless relationship-building (or rekindling if it’s been a long time since the last discussion) and business development opportunities: If they’ve just closed a fund, put out a call to hear about their strike zone. If their portfolio company just closed three add-ons, be sure to discuss the exit/sale timeline in your next meeting. If they submitted a particularly high bid on a deal of yours, have them detail what made them so excited about the transaction.

This type of transparency will help your team execute on its business development efforts more quickly, and with more confidence. It will also make for stronger, longer-lasting relationships.

Who are we missing?

Total sponsor relationship management is something that all firms pursue, but is also extremely difficult to obtain. That’s why it’s so important to regularly evaluate who is missing from your stable of sponsors, and what pitfalls exist in your processes that are prohibiting you from this goal. If you do have identified inefficiencies that you’d like to work on, you don’t have to go it alone.

We’ve helped countless investment banks of all sizes optimize or re-vamp their sponsor coverage model and strategy – talk to us to learn more.