For the 10th year in a row, Bain & Company has released its Private equity Report, which serves as a “state of the state” for many capital markets participants of all shapes and sizes. While many would argue that the private equity landscape has remained largely the same (competitive, fragmented, etc.) over the past decade, this particular report leverages Preqin data to analyze the minutiae of the industry, down to the tiniest strategies firms are deploying in an effort to get ahead.

This year, instead of just reading the report, we’re working with our clients to find ways to make these insights more actionable. In this article, we review two of the most poignant market trends discussed in the report, and provide best practices for tracking those trends and data points in your CRM.

“Sectors with room to run”

It’s no surprise that “buy-and-build” strategies remained popular amongst private equity players in 2018. But that doesn’t mean that it’s gotten any easier to derive value from these transactions. According to the Bain & Company report, “Sector dynamics can have a huge impact on the success or failure of a given buy-and-build strategy. Value creation depends on a steady cadence of acquisitions, which means a sector has to provide an ample supply of targets and a stable environment in which to pursue them.”

In light of this observed trend, sponsors should create dashboards that enable monitoring of each sector in which a roll-up strategy could be successful, as well as all of the companies that could be included as acquisition targets. Firms can build these dashboards in a few ways: by configuring your proprietary data in a way that tags and categorizes private companies consistently with your add-on interests in mind; by leveraging third-party data providers such as PrivCo which allow you to identify and target U.S. private companies that meet your add-on criteria; or by fusing both of the aforementioned tactics together (this is our best recommendation).

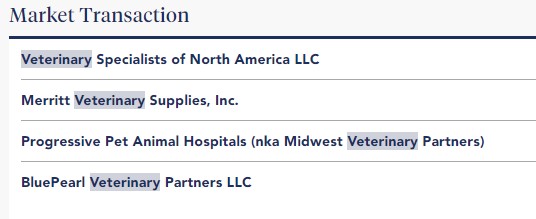

The Bain report cites the number of veterinary businesses in the U.S. as an example of an industry to watch because there’s “plenty of runway for future consolidators.” Using that same niche industry as an example, we also recommend indexing closed deals (as seen to the right), which will help your firm track industry-specific consolidation trends and competitors.

“Merger integration: stepping up to the challenge”

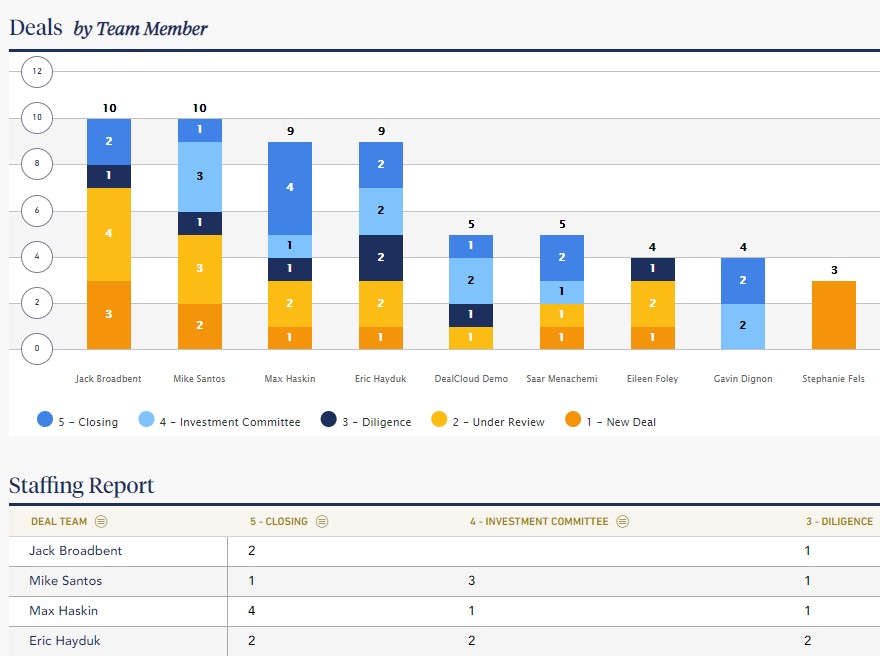

Bain’s research also found that “broken deals tend to fail because firms stumble over merger integration,” and that “successful merger integration begins with strong due diligence.” In light of this observed trend, we recommend that firms create staffing dashboards. By tracking each team member’s ongoing workload (i.e., the deals that they are working on, and what stage each is in, as seen below), the firm’s leadership team will be better positioned to assess which individuals have the bandwidth to participate in the diligence process, and which do not. In doing this, due diligence processes will get the attention and care they so desperately require, and the merger integration will be set up to succeed.

The firm can set rules for over- and under-staffing (e.g., managing 10 or more deals is too much, and three or fewer deals is too little). From there, we recommend setting notifications for when those thresholds are crossed. These systems are easy to set up, and can help to ensure that team members who are leading due diligence processes aren’t being distracted by too many other responsibilities. More broadly, these measures can help facilitate better resource allocation.

From cost estimates and revenue synergies, to crafting an integration thesis, the Bain report provides excellent tips on key questions to ask during diligence. But if your team isn’t prepared to dedicate meaningful time and resources to those questions, they’ll surely never get answered, and the investment will suffer as a result.

Conclusion

Gone are the days of not tracking these capital market trends in your CRM. It’s time for firms to turn these insights into institutional knowledge, and it seems like the folks at Bain & Company agree: “At a time when PE firms face soaring asset prices and heavy competition for deals, advanced analytics can help them derive the kinds of proprietary insights that give them an essential edge against rivals.”

If you’d like to learn more about configuring your instance of Intapp DealCloud to better track these trends, let us know, and we would be happy to share our tips and best practices.