Investment bankers must work harder and smarter to show their value and stay in the minds of their clients and sponsors. Over the past decade, successful firms have invested time and resources into technology to transform how they operate.

Investment banks must consider various factors when implementing and rolling out new technology. Before selecting a technology platform, firms should review how each team member works, regardless of their experience.

This article discusses the key goals investment banks should have for their team, based on the seniority level of the banker. It also shows how our clients are making those goals a reality by leveraging Intapp DealCloud’s purpose-built technology.

Managing Directors

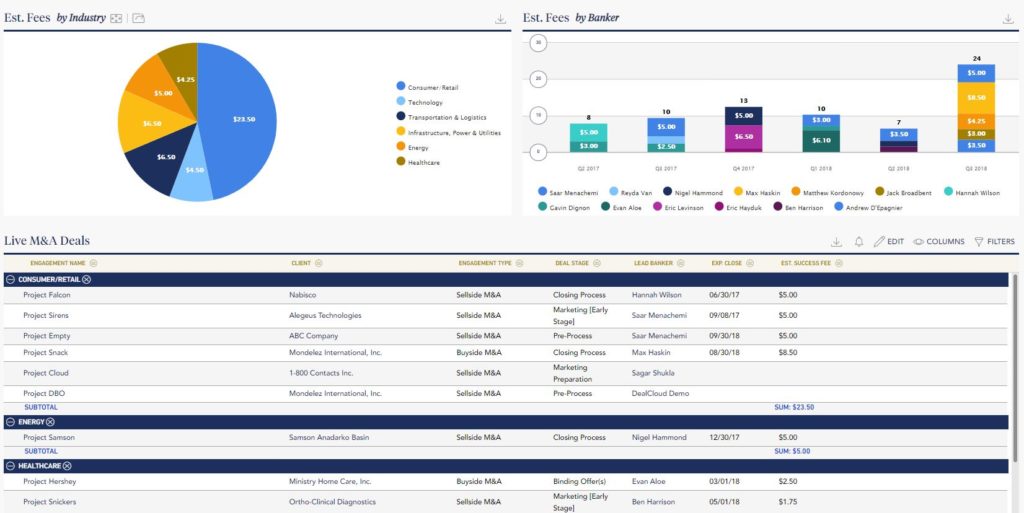

Managing Directors (MDs) are key relationship managers that require quick access to accounts and opportunities, wherever they are. Bankers at this level use technology to stay informed on industry trends, market movements, and the firm’s year-over-year successes and shortcomings. With a technology system like DealCloud, MDs can:

- Access real time views of the current pipeline: MDs need to know where every deal stands in the pipeline. This helps them address certain questions and challenges without confusion or delay.

- Gain a 360⁰ view of the client relationship:

- Because MDs manage key relationships, they need client-centric dashboards that highlight past conversations. Third-party data can also be leveraged to enrich the dashboards.

- Benchmark performance and drive resource allocation: Tracking revenue by business unit or industry is important for MDs. They also need to track banker productivity to make more informed staffing and hiring decisions.

- Optimize and track firm strategy: MDs also need to keep their eyes on long-term goals. They should seek out tools that allow them to pull automated reports weekly, monthly, and quarterly.

Dashboards, like the one seen above, help Managing Directors stay abreast of fee generation and live deals with one click.

Vice Presidents and Directors

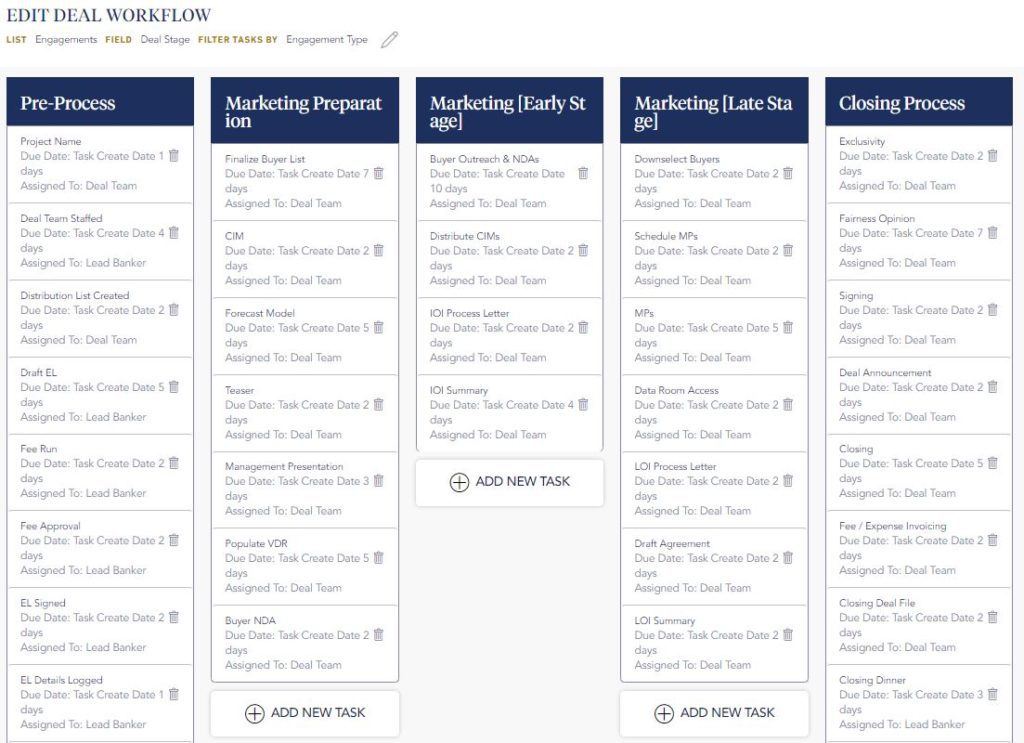

Vice Presidents (VPs) and Directors share similarities with MDs as they often oversee key relationships. They differ because they are also more frequently involved in managing ongoing deals. VPs and Directors are responsible for driving more profitable business from clients and communicating across product specialists, managers, and client teams. Because of that, they require unique capabilities that help them execute day-to-day, such as:

- Easy access to client communications:

They need to be able to quickly access data on deals, meetings, contacts, emails, etc. while at their desktop or on-the-go. - Cross-product communication and collaboration: VPs need proactive notifications for specific activities that spur further collaboration across industry verticals or products.

- Staffing and resource management:

If they manage teams, they require real-time views of their teams’ workload and capacity to efficiently manage resources. - Automate deal workflows and checklists:

VPs and directors are typically the ones responsible for making sure all due diligence items are checked. They need a workflow engine that can automate, assign, and monitor the tasks from start to close.

VPs and Directors can quickly and easily edit their deal workflow using DealCloud.

Analysts and Associates

Access to training and support for new technology is critical for investment banking analysts and associates. Once comfortable with the system, it’s important that they incorporate the technology into their everyday dealmaking activities.

These team members are responsible for executing tasks and project management. The items below can make a huge difference in the productivity of a junior-level banker or M&A advisor:

- Aggregate market intelligence: Analysts must have a centralized platform to store and access data. With DataCortex, analysts can search various third-party data providers such as Pitchbook, FactSet, Preqin, etc. from the platform.

- Track every client interaction:

- Junior bankers need to easily sync all client interactions in one place, especially for in-flight deals.

- Track productivity: We’ve seen countless investment banks and advisory firms build productivity dashboards. This helps increase the level of team-wide transparency and shows a junior-level banker exactly where they stand as compared to their peers.

Junior bankers can use charts in DealCloud to track if they are keeping up with their peers’ business development activities.

Don’t just set arbitrary goals for your firm, make them a reality. Aligning your technology to the goals for your organization can help you achieve them. Be sure to gather input from all parties, and you’ll find greater success when it’s time for implementation and adoption.

Get in touch with our team and learn how Intapp DealCloud can help your investment banking firm.