No stranger to the daily highs and lows of the modern private capital markets and public capital markets, Lauren Dillard (EVP of Global Information Services at Nasdaq) recently chatted with DealCloud Co-Founder Ben Harrison about the biggest trends affecting dealmakers today. They also discussed the organizational best practices that the leading firms of the future can take into 2021.

While 2020 has been tough for so many firms and businesses, both the public and private markets have seen highs and lows. Below, we highlight the key takeaways from their discussion that should act as useful lessons for dealmakers to take into 2021 and beyond.

Open and transparent capital markets are a way for dealmakers to express confidence

While in-person dealmaking opportunities nearly vanished in 2020, dealmakers have relied heavily on data and other insights to navigate the capital markets. In some ways, the availability of and reliance on data has made both the public and private markets more accessible than ever before, even in a pandemic.

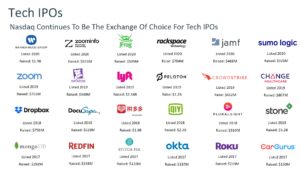

Dillard noted that when Covid-19 first hit, the companies that accessed the capital markets were primarily healthcare and biotech, and that was a trend observed by all. That later shifted in April, when technology companies suddenly began to take center stage. Since April, there have been an extraordinary number of listings. There were 15 IPOs in one a week alone. The amount of money being raised is quite unprecedented, not unlike so many other things in 2020. This is all fueled by dealmakers who feel that the public and private capital markets are open and transparent, and in many ways, more accessible thanks to the power of technology and data.

Source: eVestment

The above tech companies have listed their shares on Nasdaq’s exchange.

Comparable companies, new allocations, and at-risk allocations are top-of-mind for dealmakers

While the public and private markets have vast differences, there are signals sent back and forth between the two that can help dealmakers gain an advantage. Public market data shows private markets investors where allocations are going, what comparable companies are transacting, where fees are going, and also shines a light on investor sentiment and behavior. Interestingly, Nasdaq’s data arm, eVestment, began collecting Covid-19 “response statements” in early 2020 that provided a very interesting and rare chance to get an insider’s view into the future. By collecting and centralizing that data, dealmakers can better predict market transactions, industries that will be negatively affected, and overall sentiment.

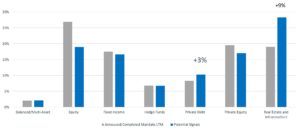

Mandates for private debt, real estate, and real assets investment vehicles are on the rise

A global signal being observed is that, to the surprise of many, dealmakers are increasing their search activity in certain industries, like real estate. With the public markets rebounding, allocations towards the private markets – specifically in private debt, real assets, and the aforementioned real estate sector – also continue to rise, according to the eVestment data. Even with the enormous amount of IPOs that we have witnessed in 2020 thus far, the private markets are still ripe for opportunity.

Source: eVestment

The Private Debt and Real Estate and Infrastructure sectors lend increasing opportunity within the private capital markets.

ESG is top-of-mind

According to a recent eVestment article, “more and more institutional investors are screening ESG strategies and generating demand for actual ESG products. At the same time, how they think about ESG is constantly evolving.” That’s why eVestment continuously updates their ESG questionnaire, in collaboration with investors and consultants worldwide, to ensure managers are reporting the ESG data asset owners and allocators care about.

For more information on ESG trends that are affecting the public markets that may be predictive or insightful for the private markets, listen to the podcast below:

Conclusion

Technology and data are the single most important driver in successfully competing for deals. Insight into public market trends give professionals the ability to move quickly, stay in-the-know, and achieve a sustainable competitive advantage in today’s private capital markets landscape.

To learn more about how DealCloud helps dealmakers make sense of their data and insights, click here.