Credit and leveraged finance software for debt capital markets

Create more efficiency to close more deals

Expand your network, close more deals, and generate higher returns. By creating a single source of truth for all information regarding deals, relationships, and capital deployment, Intapp DealCloud helps your credit investment firm operate more efficiently and strategically.

Manage your deals and relationships with Intapp DealCloud for private credit

Boost win rates and expedite decision-making by unlocking a holistic view of relationships, pipeline, facilities, and market activity.

Close more deals

Accelerate deals as they move through every stage in the pipeline with technology built for your dealflow.

Strengthen relationships

Discover and nurture meaningful connections with AI-driven relationship intelligence.

Source more business

Identify opportunities and make smarter decisions with one central source of truth.

Improving how you manage relationships

DealCloud’s understanding of the deal process and CRM needs of investment teams is unique.

Our firm has deep relationships across the market, and the ease of day-to-day use and out-of-the-box reporting has significantly improved the way we manage these relationships.

Streamline deal sourcing and execution with DealCloud for private credit

Relationship management

Build strong relationships with AI-driven intelligence reporting, automated data capture, and centralized coverage.

Marketing integration

Maximize branded email campaigns and firm outreach with integrated tools to design and send campaigns as well as analyze campaign results.

Business development

Discover new opportunities by monitoring sponsor and lender relationships alongside market activity.

Pipeline management

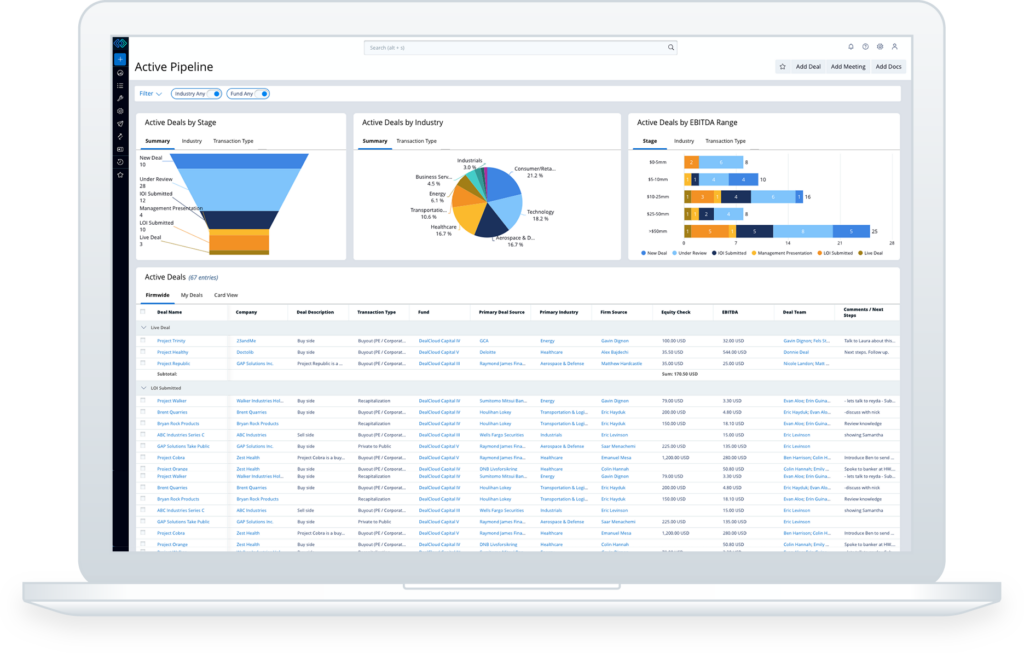

Improve decision-making by centralizing target pipeline and facility-level metrics.

Deal execution and collaboration

Centralize your due diligence checklists and approval workflows in an organized and efficiently managed information hub.

Fundraising and investor relations

Synthesize complex firm data and drive efficiencies in investor outreach, lead progression, and fund management.

Firm knowledge

Accelerate communication sharing and improve decision-making with increased institutional knowledge.

Leading credit firms rely on Intapp DealCloud for deal and relationship management

Revolutionize private credit investing with centralized deal and relationship management

Real-time institutional knowledge sharing

Improve communication and inform decision-making with unified workflows and intelligence.

Automated workflows, alerts, and reports

Stay on top of deal-related tasks using automated workflows, notifications, and AI-generated signals — on either desktop or mobile.

Reporting and analytics

Visualize firmwide pipeline and inform deal execution with reports, dashboards, tearsheets, and other customizable resources.

AI summaries and recommendations

Save time with AI summaries of deal information and make better decisions using AI recommendations based on firm and market intelligence.

System integrations

Share data across your firm with a centralized hub that connects with Microsoft 365 and other applications your team uses every day.

Actionable data

Transform your proprietary and third-party data into institutional knowledge to empower your dealmakers.

Frequently asked questions about Intapp DealCloud deal and relationship management

-

Global capital markets participants rely on lenders and credit advisory firms to provide flexible, innovative, readily available financing solutions. Because of this, lending firms are tasked with developing relationships with a wide array of professionals at every stage of the transaction lifecycle. Without the right technology platform in place, lenders and credit advisors are at risk of losing those relationships or letting them grow stale.

By creating a single source of truth for all information regarding deals, relationships, and funds, Intapp DealCloud helps debt capital markets (DCM) participants operate more efficiently and strategically. Intapp DealCloud technology was built exclusively for the financial services market, with the understanding that every firm is unique and should have the power to configure each of its systems and processes into one unified technology platform. Debt providers of all shapes and sizes rely on our product, ranging from high-volume, small-business lending firms to the firms large enough to make headlines.

-

Lenders need the freedom and flexibility to pivot from deal to deal and relationship to relationship. That’s why best-in-class debt capital firms leverage the Intapp DealCloud platform to deploy capital and grow their practices more effectively. Track private credit activities, including but not limited to private company monitoring, sponsor and bank coverage, travel planning, deal and legal document management, time tracking, business development activity tracking, industry analysis, deal marketing, and compliance and risk management.

-

Since industry experts built our platform, we know that not all debt capital markets firms operate in the same way. The pipeline, relationship management, and reporting needs of one user, team, division, or company can differ greatly from the next. That’s why our users have the power and precise control to tailor Intapp DealCloud on a user–by–user basis: so every individual has the tools and the views they need to facilitate the flow of information — intuitively, simply, and with the right levels of access. When it comes to reporting and analytics, you can customize every dashboard, chart, graph, tearsheet, data sheet, and profile to meet your leveraged finance professionals’ preferences and interests.

Schedule a demo

Speak with a private capital industry expert

Fill out the form and someone will be in touch to provide a demo.

Intapp Intelligent Cloud

For more than a decade, Intapp has been bringing the power of automation and intelligence to professional and financial services firms — helping clients like you solve their specialized needs and challenges.

Intapp Cloud Infrastructure

Use AI confidently, knowing we keep your data secure through our partnership with Microsoft and our own commitment to security and compliance.

Learn more about our cloud infrastructureIntapp Data Architecture

Quality data is at the heart of good AI — and with Intapp, you benefit from our data architecture.

Learn more about our data architectureIntapp Applied AI

Our Applied AI strategy includes five essential AI capabilities that help you make smarter decisions, faster.

Learn more about our Applied AI strategy