Family offices deal management software

Gain a competitive advantage for your firm with efficient deal and pipeline management

Grow your network, close more deals, and get higher returns with Intapp DealCloud. With a single source of truth for all your firm data — including deals, relationships, and capital deployment — your firm can operate more efficiently and strategically.

Close more deals and better manage your pipeline with Intapp DealCloud for family offices

Unlock a holistic view of your relationship, pipeline, and market activity so you can accelerate decision-making and grow your pipeline.

Close more deals

Expedite deal closures through every stage of the pipeline with workflows designed for firm processes.

Strengthen firm relationships

Discover, create, and nurture valuable connections with key, AI-driven relationship intelligence.

Source more deals

Find more opportunities and make better decisions with a single source of truth.

Consolidate your various systems into one platform

The DealCloud team has demonstrated a deep understanding of our activities and our specific needs as a family office. With DealCloud, we better monitor interactions with our contacts and improve our deal flow management efficiency.

Identify, pursue, and close more deals with Intapp DealCloud for family offices

Relationship management

Nurture stronger relationships with AI-driven intelligence reporting, centralized coverage, and automated data capture.

Marketing integration

Reach more prospects with a full suite of tools to create, send, and analyze branded email campaigns.

Business development

Find new opportunities by analyzing intermediary and general partner relationships alongside market activity.

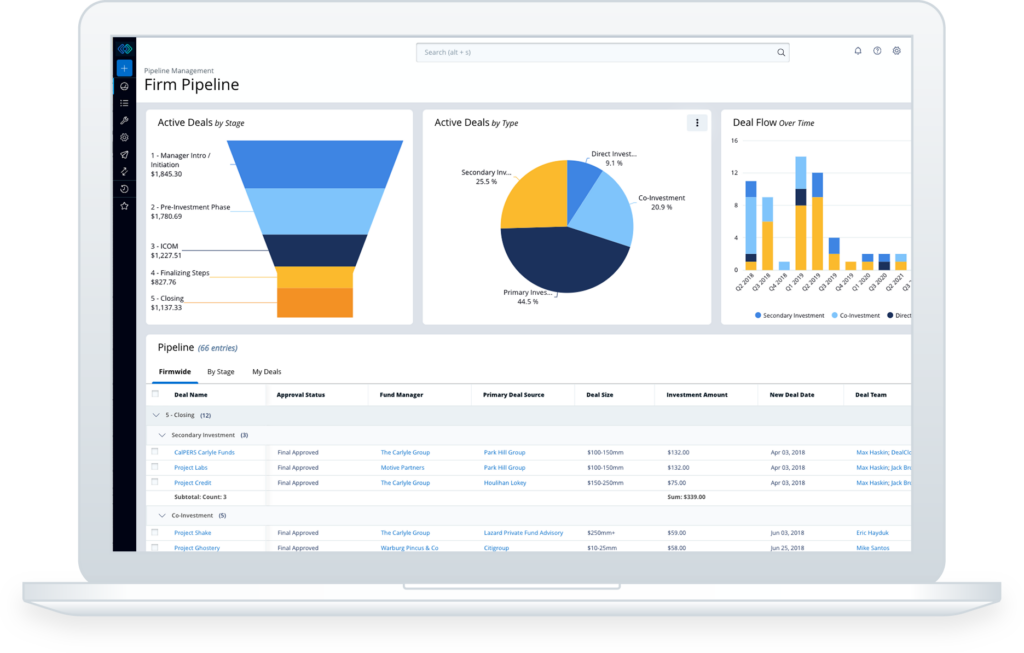

Pipeline management

Centralize your target pipeline, better manage your resources, and improve decision-making.

Deal execution and collaboration

Access and manage your due diligence checklists and approval workflows within a centralized and organized information hub.

Fundraising and investor relations

Improve investor outreach, lead progression, and fund management with more data visibility.

Firm knowledge

Share information across your firm more easily and improve decision–making.

Leading family offices rely on Intapp DealCloud for deal and relationship management

Grow your family office firm with simplified deal and relationship management

Real-time firmwide knowledge sharing

Improve communication and decision–making with better workflows and intelligence.

Automated workflows, reports, and alerts

Stay up to date on deals with notifications, automated task workflows, and AI-generated alerts on desktop or mobile.

Reporting and analytics

Gain a full view of your entire firm pipeline with reports, tear sheets, dashboards, and other customizable resources for better deal execution.

AI summaries and recommendations

Save time and make smarter deal decisions with AI summaries and recommendations based on firm and market intelligence.

System integrations

Share data across your firm with a single hub that connects with Microsoft 365 and other applications your team relies on.

Actionable data

Better equip your dealmakers by transforming your proprietary and third-party data into firmwide knowledge.

Frequently asked questions about Intapp DealCloud deal and relationship management

-

Single and multifamily office investors are tasked with wearing many hats, from sourcing and origination to deal execution and closing. Without the right technology to manage day-to-day operations and activities, family offices risk losing deals to private equity funds with larger teams and more resources. Intapp DealCloud helps family offices centralize their institutional knowledge and relationship capital all in one place — and provides them with the intelligence and data they need to compete in an increasingly crowded market. Our solution ensures that investors find the right people, deliver the right message, participate in winnable deals, and manage key relationships successfully.

Whether your firm has just closed its first fund or completed hundreds of transactions, our vertical-specific software will help your firm grow and operate more efficiently. A rich set of tools and features accompanying our core CRM platform also lets investors quickly complete administrative, time-intensive parts of their job — giving your firm’s professionals more time to build and grow relationships that lead to closed deals.

-

Intapp DealCloud’s family office software helps family offices manage their deal processes and key relationships. Our tools enable investment professionals to understand and manage the complex ecosystem surrounding a deal. Family office professionals leverage Intapp DealCloud’s platform for deal and pipeline management; intermediary and lender coverage; portfolio monitoring and reporting; travel planning; time tracking; business development activity tracking; fundraising and IR; bid analysis; and conflicts checks.

-

Our platform was built by industry experts who know that not all family offices operate the same way. The pipeline, relationship management, and reporting needs of one user, team, division, or company may differ greatly from the next. That’s why our users have the granular control to tailor Intapp DealCloud on a user-by-user basis — so that every individual has the tools and the views they need. When it comes to reporting and analytics, your team members can customize every dashboard, chart, graph, tear sheet, data sheet, and profile to meet their preferences and interests.

Schedule a demo

Speak with a private capital industry expert

Fill out the form and someone will be in touch to provide a demo.

Intapp Intelligent Cloud

For more than a decade, Intapp has been bringing the power of automation and intelligence to professional and financial services firms — helping clients like you solve their specialized needs and challenges.

Intapp Cloud Infrastructure

Use AI confidently, knowing we keep your data secure through our partnership with Microsoft and our own commitment to security and compliance.

Learn more about our cloud infrastructureIntapp Data Architecture

Quality data is at the heart of good AI — and with Intapp, you benefit from our data architecture.

Learn more about our data architectureIntapp Applied AI

Our Applied AI strategy includes five essential AI capabilities that help you make smarter decisions, faster.

Learn more about our Applied AI strategy