Software and solutions for private capital markets

Achieve long-term success for your firm — with a platform for capital markets

Now, equip your dealmakers with a data management solution that was built for how your firm executes private capital investing deals. With one central hub of information and management, you can improve operations, expedite risk management, and increase data visibility.

Create greater institutional knowledge across your firm and identify more opportunities — all with Intapp DealCloud and Intapp Solutions for private capital.

Powering end-to-end private capital investment solutions

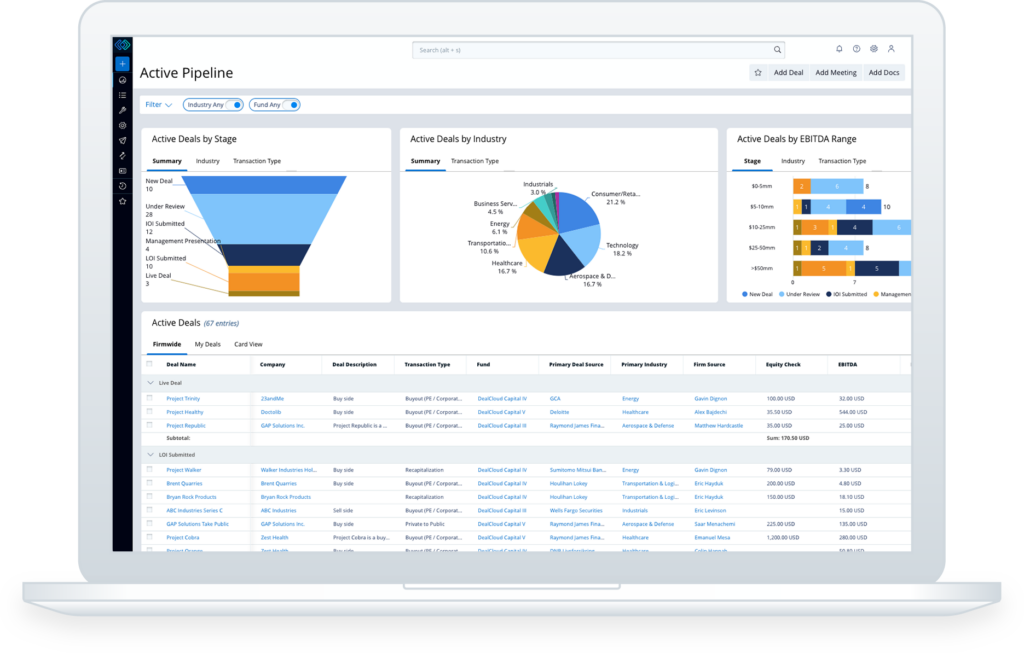

Intapp DealCloud

Boost win rates and increase operational efficiency by nurturing meaningful relationships, analyzing market trends, and streamlining deal execution. Better manage your relationships and active targets — and close more deals.

Intapp Collaboration and Content

Get more out of Microsoft 365 with secure workspaces that enhance collaboration and deal execution while streamlining content management. Mitigate information governance risk, improve deal workflows, and automatically create deal-centric Microsoft Teams and SharePoint workspaces all while making content accessible to the right team members.

Intapp Conflicts

Accelerate approvals by simplifying the review and clearance process for conflicts of interest. Intapp Conflicts gives your team a centralized solution for searching, identifying, and mitigating potential risks and allows you to maintain comprehensive diligence to protect your firm’s reputation. With built-in AI clearance, your teams can easily search against internal firm data and trusted third-party data sources to make informed, data-driven decisions faster.

Intapp Employee Compliance

Reduce compliance risk with one intuitive platform. Review and manage employees’ outside business activities, personal investments, potential conflicts, political activity, and attestation documents. Increase investor confidence by demonstrating adherence to internal code-of-ethics policies and regulatory requirements. All using Intapp Employee Compliance.

Leading private capital markets firms choose Intapp

Gain confidence in a streamlined

decision-making process

DealCloud has transformed our organization far beyond operational improvements. The tool … replaces frustration with collaboration, and this continues to strengthen our corporate culture.

Our senior management has confidence in our streamlined decision-making process, which frees up time to grow our business.

Schedule a demo

Speak with a private capital industry expert

Fill out the form and someone will be in touch to provide a demo.

Intapp Intelligent Cloud

For more than a decade, Intapp has been bringing the power of automation and intelligence to professional and financial services firms — helping clients like you solve their specialized needs and challenges.

Intapp Cloud Infrastructure

Use AI confidently, knowing we keep your data secure through our partnership with Microsoft and our own commitment to security and compliance.

Learn more about our cloud infrastructureIntapp Data Architecture

Quality data is at the heart of good AI — and with Intapp, you benefit from our data architecture.

Learn more about our data architectureIntapp Applied AI

Our Applied AI strategy includes five essential AI capabilities that help you make smarter decisions, faster.

Learn more about our Applied AI strategy