Intapp DealCloud relationship management

Grow your business with intelligent relationship management

Reduce the need for manual data entry and the mistakes that come with it. Automate the capture of contacts and companies, enrich accounts with relationship intelligence and third-party datasets, and systemize outreach workflows via notifications.

Empower your professionals to shift their focus away from administrative tasks and back to expanding their networks and growing your firm’s business.

Enhance your relationships and inform business development

Discover connections and expand your network with valuable relationship intelligence and CRM workflows.

Boost efficiency

Sync relationship and activity data with automated data capture.

Expand your network

Discover and enrich relationship data through third-party integrations.

Streamline outreach

Expedite outreach with AI-driven relationship signals and content generation.

A more efficient collaboration engine

DealCloud’s solution provides us with a more effective and efficient collaboration engine across our business workflows, enabling us to enhance our client relationships, while increasing the company’s performance. We are also very satisfied with the agility and the bespoke support provided by their team of experts.

Leading firms trust DealCloud for relationship management

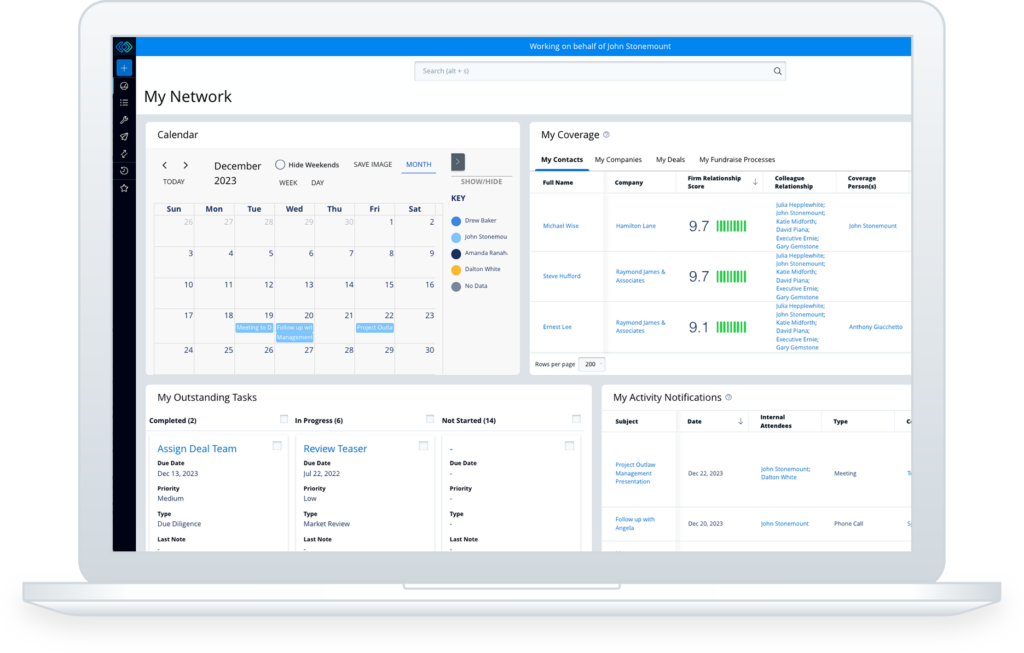

Power growth with relationship insights, real-time dashboards, and flexible configurations

Relationship scoring

Generate insights and strategies from relationship strength scores.

Automated contact and company capture

Automatically create and maintain company and contact records discovered through your firm’s email communications.

Zero-entry activity capture

Centralize firm interactions with automated email and event synchronization.

Relationship signals

Access an AI-driven relationship intelligence feed with actionable reminders and insights for contacts and events.

Flexible relationship ownership

Use flexible tagging to enforce accountability, and reward relationship and task ownership.

Fully configurable permissions

Easily manage contact and activity data access for individual users and roles.

Frequently asked questions about DealCloud’s relationship management solutions

-

DealCloud was founded specifically with the needs of financial and professional services firms in mind. We built our CRM to be flexible and configurable to meet the changing needs of dealmakers in the professional and financial services industry. It’s built for private capital markets; legal, accounting, and consulting firms; and highly acquisitive private and public companies, like investment banks, real estate investment firms, and M&A advisory firms. No matter your organizational structure, strategy, mandate, or fund size, DealCloud’s cloud-based CRM creates a single source of truth for your firm’s institutional knowledge.

-

Generic, industry-agnostic CRM systems can become a roadblock to success in the increasingly competitive and crowded financial and professional services industry. DealCloud’s deal management CRM technology empowers dealmakers to harness the cumulative intellectual capital of their people and processes. With DealCloud’s CRM, professionals get a single source of truth to help them manage relationships, execute deals, and easily connect with external solutions and third-party data providers such as PitchBook, FactSet, Preqin, and more. Using DealCloud’s marketing automation tool, Dispatch, and our third-party data tool, DataCortex, dealmakers can integrate email marketing analytics and third-party data to help them manage relationships and identify opportunities.

-

Intapp DealCloud is both custom-fit for complex relationships and transaction structures and built to adapt to the specific ways each firm works. Design custom outreach notifications and email templates, configure data quality and collection controls, and build custom categorization and tiering systems that streamline relationship management efforts. With Intapp DealCloud’s automation controls, administrators can set unique controls based on contact and company criteria. This will determine whether records should sync automatically to your firm’s DealCloud data set or be sent for additional review before data synchronization. These controls strenghthen data integrity by enabling your firm to retain ownership of the data that enters the platform.

Schedule a demo of Intapp DealCloud

Speak with an expert

Fill out the form and someone will be in touch to schedule a demo.

Intapp Intelligent Cloud

For more than a decade, Intapp has been bringing the power of automation and intelligence to professional and financial services firms — helping clients like you solve their specialized needs and challenges.

Intapp Cloud Infrastructure

Use AI confidently, knowing we keep your data secure through our partnership with Microsoft and our own commitment to security and compliance.

Learn more about our cloud infrastructureIntapp Data Architecture

Quality data is at the heart of good AI — and with Intapp, you benefit from our data architecture.

Learn more about our data architectureIntapp Applied AI

Our Applied AI strategy includes five essential AI capabilities that help you make smarter decisions, faster.

Learn more about our Applied AI strategy